NAVIGATOR FUND: A Potential Investment Solution for Uncertain Times

The Problem: Both equity and bond valuations are near historic highs and their diversifying benefits in a portfolio are suspect going forward.

Equities

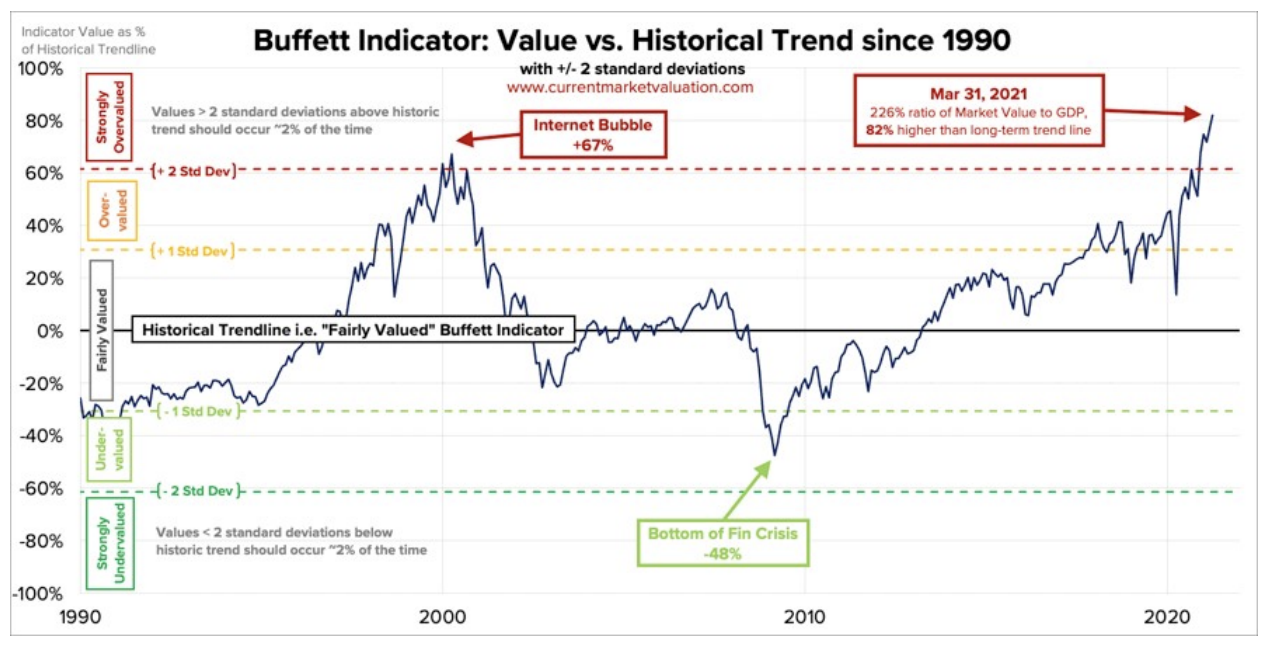

At current levels, many equity valuation indicators suggest unprecedented froth. The simplistic “Buffet Indicator” is a ratio of total United States stock market valuation to GDP. At one time, Warren Buffet called this ratio, “the best single measure of where valuations stand at any given moment.” It is near all-time highs. If we calculate this indicator from March 31, 2021:

Aggregate US Market Value: $49.3 Trillion

Current Quarter Annualized GDP (Estimate): $21.8 Trillion

Buffet Indicator: $49.3T/$21.8T = 226

This is approximately 82% above the historical average

Bonds

We believe bond valuations offer very little reward for potentially enormous risk in a fast-moving inflationary environment. Investing in the current bond market may offer a risk/return profile akin to the proverbial, “picking up pennies in front of bulldozer”. Even if an investor is willing to go deeper into low-grade high-yielding instruments, then they risk high correlation to equities when markets tank. The latest COVID equity market showed the high correlation of equities to high yield instruments. The below chart illustrates the historic low yield relative to the last 54 years.

10-year Treasury Rate 54 Year Chart

An Alternative Solution

The Navigator Fund (UNAVX) strategy is designed to have modest drawdowns relative to equity markets when equities and/or bonds tank meaningfully. It is also designed to have an independent return sequence to broader equity and bond market indices. It seeks to accomplish these goals with rules-based trading that exploits the behavioral herding of market participants. It uses the following risk management levers:

• Firm stop-losses on all open underlying positions

• Overnight option hedges against adverse short-term “tail moves”

• Only entering positions when the model detects an asymmetry skewed to reward over risk

We do not have an opinion on the mid or long-term movement of the equity or bond markets. We simply believe that our strategy offers an alternative that has 1) a higher probability of positive return streams without the “white knuckle” rollercoaster ride of equities or 2) the low-reward and potentially high risk offered in today’s bond market.

Sincerely yours,

SYMBOL: UNAVX